Dental membership plans have become a lifeline for both patients seeking affordable dental care and dental practices looking to increase patient loyalty and revenue. However, one often underestimated aspect of running a successful dental membership plan is compliance.

There are a lot of misconceptions around membership plan compliance — and, it can introduce hurdles, especially for dental groups that operate in multiple states. Here, we’ll break down how requirements vary from state to state and common challenges to keep an eye out for.

Membership Plan Compliance: Requirements and Risks

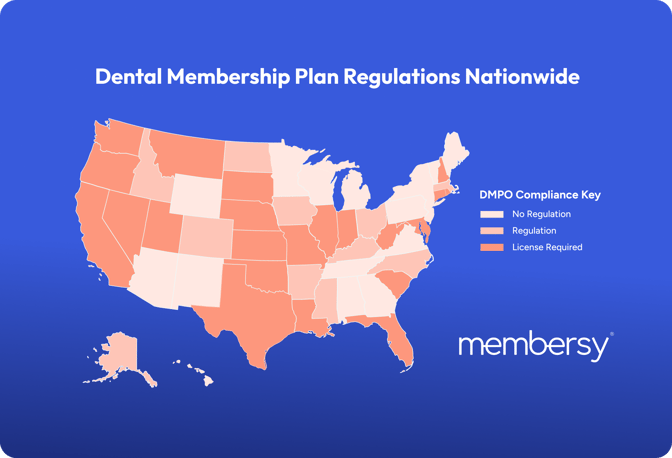

A dental membership plan that charges a fee for access to discounted services is, by definition, a Discount Medical Plan (DMP). Because of that, membership plans are currently subject to regulation in a total of 35 states. Of those states, 25 require that the discount medical plan operator (or DMPO) obtain a license from the state insurance department prior to engaging in any DMPO activity.

Failure to maintain the right licensure can result in serious consequences for your plan and your practice. Possible penalties include administrative actions, fines, disgorgement of enrollment fees, and suspension or termination of the plan.

It’s clear that attaining and maintaining licensure is critical for compliance — but, it’s not always an easy process.

Navigating the Maze of State Licensure

Many states have their own DMPO licensing process, and some can be particularly challenging. States like Illinois, Louisiana, and Oklahoma present substantial hurdles in the form of an extensive initial application process, while Texas and Florida even go as far as collecting fingerprints from plan operators. Florida also requires third-party background checks, and states like Washington rarely even issue new licenses.

One state that stands out for its rigorous compliance requirements is California. After an exhaustive initial licensure process, plans are bound by a litany of ongoing obligations, including new network filings, annual and quarterly compliance submissions, state assessments, annual and quarterly financial filings, audited financials, routine operational surveys and financial audits, and other requirements.

Common Challenges in Obtaining DMPO Licensure

While the specific licensure process varies from state to state, dental practices often encounter three recurring obstacles.

-

Filing lift: The administrative and legal work required to file and obtain a license can be extensive. A typical license requires initial and annual renewal applications, a surety bond, application and bond fees, and submission and review of plan materials. Following submission, the back-and-forth with state regulators prior to approval can extend months, even years.

-

Financial resources: Once you’ve completed these time-consuming filings, application and renewal fees for DMPO licensure can range from $500 to $2,000, depending on the state. Licensees are also often required to obtain a surety bond, which can run between $500-$1,000 per year. There may even be a state assessment or a set fee per member, that must be taken into account.

-

Ongoing expertise: Once you’ve attained a license, your plan has to adhere to the specific requirements outlined. Compliance touches almost every facet of membership plan administration, like plan design, marketing materials, fee schedules, member agreements, required disclosures, and more. Because of this, it can be difficult to stay on top of all of the local requirements, especially if you operate in multiple states.

Simplify Plan Compliance with an Experienced Partner

Navigating the complexities of dental membership plan compliance can seem overwhelming, but the good news is you don't have to be an expert. You can choose a dental membership partner with the expertise and experience needed for DMPO compliance, especially in the states where it matters most.

At Membersy, we understand the intricacies of membership plan compliance. We are currently licensed or pending in every state that requires it, and we have successfully managed the initial and ongoing licensure process in the most challenging jurisdictions in the country, including California and Washington. Our team has the expertise essential for maintaining a compliant plan that can help you achieve your revenue goals.

Ready to streamline your path to dental membership plan success? Book a consultation with Membersy today.